Paying employees on time and smoothly takes a lot of work. But with convenient Payroll Services & Software, today’s employers do it quickly. What used to be a payroll administrator’s nightmare is now a simple matter of a few clicks to get everything working.

There are even payroll service providers that offer fully automated payroll. Therefore, you can pay all your employees on time and smoothly without even lifting a finger.

In times of economic tightening, it’s essential to be as efficient as possible, and payroll services help you automate tasks that used to cost you the workforce.

From the best corporate services to simple small business payroll services, there’s something for everyone looking to get paid for 2023 today. You have to know where to look.

If you’re tired of spending hours crunching numbers and comparing data ranges, it’s time to step into the 21st century and get reliable payroll software.

Here are the top 10 payroll services and programs and where they shine.

Our Top 10 Best Payroll Services & Companies in 2023:

- Gusto: The best total payroll service

- ADP. Best for mid-sized businesses with robust payroll services

- Paychex. best for SMEs looking for more than just a salary

- Quickbooks Payroll – Best for Payroll with Comprehensive General Ledger

- Paycor. best for companies looking for scalability

- OnPay – Best for small businesses and freelance accountants

- Rippling. Best for autofill tax credits and payroll processing

- Zenefits – Best for Employee Benefits

- Square: Best for hourly workers, retailers and SMBs

- Dil. best for international teams

Compare the Top 10 Payroll Services

A Closer Look at the Top 10 Business Payroll Services

1. Gusto

Gusto is one of the best payroll services for small businesses today and is also a good option for freelancers and contractors. Providing automatic tax enrollment, an array of HR benefits including health, dental, vision, college funds, 401k and the ability to trigger unlimited payroll, Gusto is a cost-effective way for businesses to optimize their monthly bills.

It’s also lovely that Gusto integrates with many other apps, including accounting software like QuickBooks Online, Xero, and FreshBooks. You can also sync your time tracking apps (like Time Tracker or Homebase) and expense management tools like Expensify to have a comprehensive billing database.

PROS

- Handy integrations

- Fully automate payroll and taxes.

- Also suitable for contractors and freelancers

PROS

- No 24/7 customer support

- Not all HR benefits are available in all states

2. ADP

ADP is one of the oldest payroll services, online or offline, which should tell you something about how experienced these practitioners are. Offering HR benefits and services, payroll services, and time and attendance management, ADP is a professional payroll service for businesses looking for more than just basic software. From dedicated HR referrals and resource and service managers to full tax compliance, reporting, and self-service capabilities, ADP offers an impressive array of features and services.

ADP will automatically calculate tax liability, withhold and remit taxes on your behalf, and handle all reporting and issuance, including W-2 and 1099 forms. Furthermore, ADP is not limited to your local borders. This payroll service solves problems in more than 140 countries around the world.

PROS

- Superior professional features and services

- Oldest Online Payroll Services

- Full service, all-inclusive benefits and salary

CONS

- Not as cheap as some competitors.

- There are no pricing plans for tiny businesses

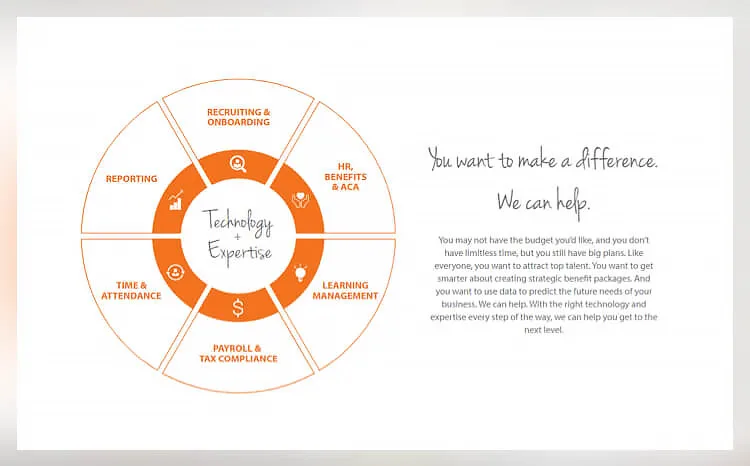

3. Paychex

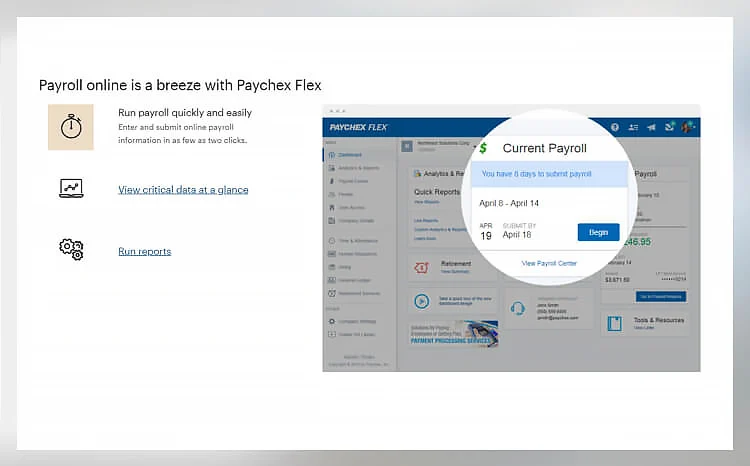

Paychex is a cloud-based payroll services provider with plans for businesses of all sizes but is especially suited for small businesses with up to 50 employees. Paychex Flex, an SMB-focused plan, lets you update your database via a desktop or mobile console, set up automated rules, and run payroll quickly and efficiently. In fact, with self-service, Paychex allows its employees to take most of the data entry off their hands entirely.

In addition to managing payroll, Paychex will calculate, pay, and file all your taxes, from local to federal. You can pay your employees by direct deposit, paper check, or credit card, whichever works best for you. Paychex plans include onboarding, HR analytics, and an event calendar for seamless billing.

PROS

- Easy-to-use software that anyone can run

- It is an excellent option for small businesses.

- Accessible without loss of features

CONS

- Many reporting options can be confusing

- Need to get used to the release of a new version

4.QuickBooks

Intuit’s QuickBooks is another popular name recently entering the payroll industry. QuickBooks, the leading accounting software, now offers payroll services that sync seamlessly with all your accounting software for an all-inclusive 360-degree service.

One of QuickBooks’ strengths is the tax filing services it offers. It is one of the best payroll service providers to manage the tax organization throughout the year. QuickBooks automatically files all your taxes, takes care of deductions, lets you create custom tax categories, and tracks sales taxes if you have an e-commerce store. It’s an elegant way to stay on top of one of the most critical aspects of your business.

PROS

- Seamless download support

- Wide range of tax filing options

- It fully integrates with your accounting software

CONS

- Not as customizable as the competition

- Not so many features are included in basic plans

5. Paycor

Paycor isn’t as well-known as big names like ADP and Gusto, but it’s still built a strong following. That’s because Paycor is a no-nonsense, feature-rich HR and payroll management service that delivers on its promises. Paycor has features like direct deposit, a convenient mobile app, streamlined payroll processing, and customizable widgets, so you can do almost anything you want within the software.

Another thing businesses like about Paycor is that it comes with many of the more sophisticated features offered by high-priced payroll service providers at a significantly lower cost.

PROS

- Competitive pricing with extensive scale

- Vast HR knowledge base.

- Powerful reporting and analysis tools

CONS

- No pricing information has been published online

- The employee review process is complex

6. Onpay

From its clean, easy-to-use interface to its unique pricing structure, Onpay offers an affordable yet customizable payroll platform for small and growing businesses. Onpay may not be the most extensive product in the payroll market, but it offers incredible depth and capabilities that allow businesses to optimize their payroll needs without much work.

For a payroll service, Onpay covers all the bases a small business will need; the platform helps you efficiently run payroll for W2 employees and 1099 contractors with automated tax filing and payments and handles payroll benefits: Human resources, workers’ compensation and insurance for all 50 states. Onpay also has impressive integration capabilities, allowing you to integrate accounting and time-tracking software that seamlessly syncs with the platform. On top of all that, the customer support team is responsive and adept at answering questions promptly.

PROS

- Extremely affordable and easy to use

- Integrations with Quickbooks, time tracking software, and more

- Automated tax registration

CONS

- Not ideal for larger companies

- Limited to US-based companies.

7. Rippling

Rippling’s payroll tool is a useful addition to your employee benefits management module, which it fully integrates with. Although the tool only supports payments by check and direct bank deposit, it can make quick payroll payments for businesses with 1 or 1,000 employees in just 90 seconds with one click.

PROS

- Integrates with the HRM component

- Pay in 90 seconds with just one click

- Automatic tax registration

CONS

- Check and bank support only

- Separate subscription to HRM

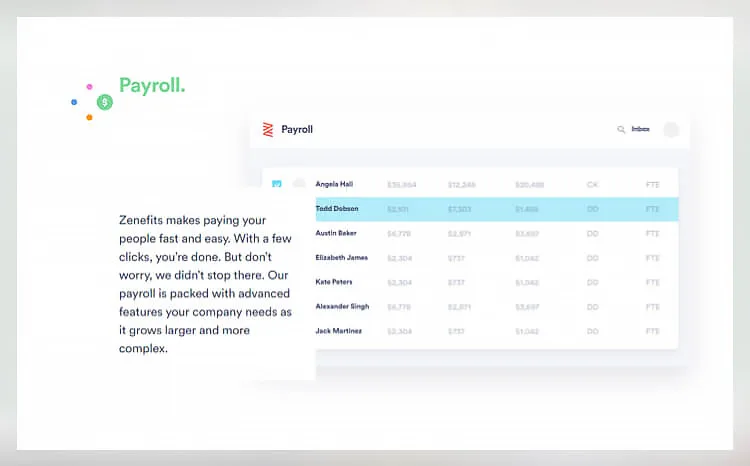

8. Zenefits

Zenefits is an easy-to-use payroll service that provides self-service by default for an easier and faster user experience. And while their payroll services are excellent, Zenefits shines in the employee benefits department. You can get everything from employee health, dental, and vision insurance to life and disability insurance, 401k retirement funds, FSA and HSA accounts, commuting benefits, and more.

That’s not to say Zenefits doesn’t have solid online payroll services because it does. Payroll is reliable and straightforward. Benefits include unlimited payments, garnishments, tip reporting, and contractor payments. You’ll also receive dynamic mobile payment receipts through an easy-to-use app.

PROS

- Extensive employee benefits

- Easy-to-use self-service dashboard

- Powerful business intelligence reports

CONS

- I can’t do everything from the mobile app

- Bit of a learning curve

9. Square

Square is one of the best small business services on the market, mainly if you already use Square for your point-of-sale needs. One of the more expensive options, Square manages your entire payroll, comes with the usual benefits like health insurance and a 401k, and has many integrations to work with.

Square fully automates your payroll, and you can run unlimited monthly payrolls. You can track employee hours, import time cards and prompts, and set and forget tax documents. Furthermore, Square is available throughout the United States. So, no matter where you are, you can access these online payroll services.

PROS

- Fast and easy-to-use software

- Work several times a month

- Affordable and feature-rich

CONS

- Reporting is limited

- Not all payment options are supported

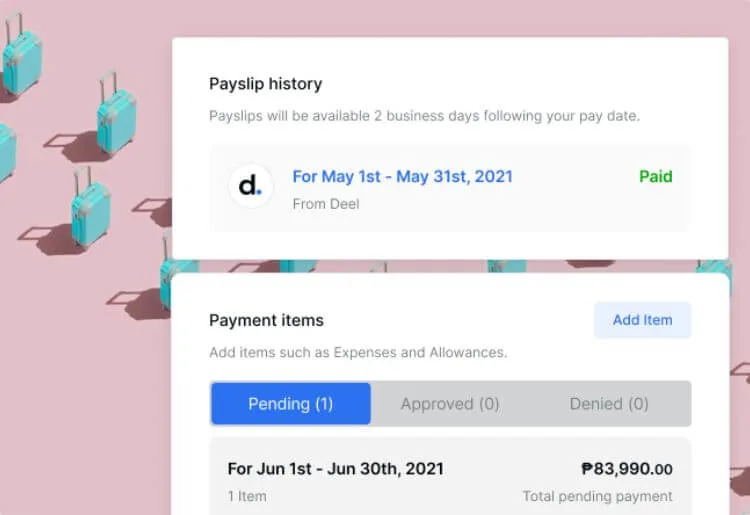

10. Deel

Deel is an excellent payroll and HR solution for international teams. You can use it as your team’s primary HR platform or integrate it with existing HR software. Deel partners with more than 200 law firms in 150 countries to ensure its platform meets these mandates.

Deel automatically considers local taxes, pension contributions, and any other local regulations when you need to pay your employees. Add all your employee compensations to one invoice in your local currency for easy payment. Additionally, employees receive their compensation in local currency. Although it can be expensive for large companies, all the features practically make Deel a must-have HR and payroll solution for international teams.

PROS

- Simple international salary

- Pay workers or contractors from 150 countries

- Multiple payment methods available

CONS

- Role-based permissions are a bit limited

- It can be expensive for larger companies

What Are Payroll Services and Software?

Payroll software and services perform the critical task of calculating and distributing employee wages, salaries, and benefits. This includes calculating gross pay, deductions such as taxes, health insurance premiums, 401(k) contributions, and take-home pay. It also helps ensure compliance with federal, state, and local tax laws.

Payroll software can also help generate reports for auditing and other purposes. Reports generated by payroll software allow a company to maintain accurate records of its finances and employee compensation information, easily accessible from one location.

Types of Payroll Services

There are four types of payroll services: in-house payroll, accountant or bookkeeper-managed payroll, agency-managed payroll, and software-managed payroll.

- internal salary

In this case, the employer manages the payroll, which can be done manually or through online software. Internal payroll is suitable for companies with a small number of employees but is notis not suitable for businesses with complex payroll needs or employees in multiple states.

- An accountant or bookkeeper manages payroll.

A third-party or certified public accountant (CPA) manages the company’s payroll using this option. This option is best suited for businesses that want to avoid the responsibility of managing their payroll or those with many employees and complex payroll requirements. It is also suitable for companies with employees in multiple states.

- Agency Managed Payroll

Using a specialized agency to manage payroll has all the benefits of an accountant or payroll managed by a certified public accountant, plus the added benefit of having an entire team of experienced payroll professionals managing your system. This increases the expertise available and is a good, albeit expensive, option for large companies.

- Managed Payroll Software

Payroll software is becoming increasingly popular among small businesses due to its cost-effectiveness and ease of use. It is usually cloud-based and can be accessed from anywhere with an internet connection, making it ideal for companies with employees in multiple locations.

What Are the Stages of Payroll Processing?

Payroll processing involves several steps, from collecting employee information to filing tax forms. Here’s a quick summary.

- Select the pay cycle. Decide how often you will pay your employees.

- Collect data. Collect employee information such as employee names and addresses, Social Security numbers, payroll information, and withholdings.

- Calculation of salaries. Use online payroll software or a manual calculation to calculate each employee’s gross wages, withholdings, taxes, and take-home pay.

- Reduce taxes and benefits. Calculate taxes and deduct benefits if applicable.

- Delivery of salary funds. Print checks, make online payments or deposit funds directly into employee bank accounts.

- Submit reports and payments. Submit required reports to state and local agencies and submit required tax forms, Social Security/Medicare payments, etc.

- Account reconciliation. This includes reconciling the payroll account with the company’s financial records to ensure the accuracy of all payments made during the payroll period.

How do You Process Payroll?

Payroll processing involves several steps: calculating payroll, withholding taxes on behalf of the government, issuing payments, submitting the employer’s tax department to the appropriate state and federal agencies, and issuing W2 forms to employees at the end of the year.

A company employee can do this manually, outsourced, or using a payroll services platform.

- Process the payroll manually.

This is often time-consuming, labour-intensive, and error-prone. Bills must be recorded accurately to avoid government penalties or fines.

- Payroll processing outsourcing

This option can benefit businesses that want the convenience of online payroll processing and access to customer service staff experienced in handling complex payroll issues.

- Using a payroll services platform to process payroll

The Payroll Services platform automatically calculates information based on employee data, such as hours worked and salary. Online platforms can also generate payroll reports quickly.

How Do Payroll Services Work?

Payroll Service is an online platform that helps businesses process their payroll needs. Several providers provide payroll services, but most online payroll services offer the same type of services.

Services typically handle the entire payroll process from start to finish through their software or website. Employers can use online payroll software to calculate each employee’s gross pay, deductions and taxes.

This software can also help withhold taxes and benefits from employee paychecks, pay workers’ compensation, file online tax returns and payments, and generate W2 forms for employees at the end of the year.

Online payroll services are excellent for companies with employees in multiple states because online service providers take care of the complexities of managing taxes, reporting, and payments in different states. Online software also makes it easy to access employee data in multiple locations.

Most services have a portal that allows employees to enter their information, such as their addresses, Social Security numbers, and bank account information. Some services also include online clocks so employees can log their hours.

In addition to basic payroll processing, some online payroll services may offer additional features such as online contractor tracking and retirement plan management.

Online services can also be integrated with other online platforms, such as accounting packages or online human resources (HR) functions that manage training and employee benefits administration.

Payroll Software Management Features

Online payroll services have several features that make managing your employees’ salaries easy. Features to look for include the following:

- Accurate calculations

Accurate payroll calculations ensure that employees are paid correctly and that the company complies with state tax laws.

- Automation

Most payroll software can automate administrative processes such as calculating withholdings, submitting reports and payments online, and processing employee W2 forms at the end of the year.

- Tax payment

Most software will help you file quarterly and annual taxes and make online payments to government tax authorities.

- Compliance updates

Online payroll services often provide updates on changes in state and federal payroll tax laws.

- Direct payments to employees

Look for payroll software that allows employees to be paid via direct deposit to ensure employees receive their payments on time and accurately.

- Customizable features

The customizable features of many payroll solutions allow business owners to tailor their payroll solutions to their specific needs.

- Employee portals

Online employee self-service portals can make uploading, information management and access to online timesheets easier and less time-consuming for HR.

- Safety

An excellent online Payroll service should provide secure data encryption measures to protect sensitive information from external threats.

- Reports and analytics

Some platforms offer reporting and analytics to help track and manage payroll data and measure overall productivity and performance.

- Interface integration

Many payroll services integrate with other online platforms, such as accounting packages.

- Mobile applications

Some online payroll services offer mobile-friendly interfaces so employees can access their information from anywhere, anytime.

How Much Do Payroll Services Cost?

The cost of online payroll services varies greatly depending on the brand and the number of features included. Most online payroll companies offer a variety of monthly plans so businesses can choose the option that best fits their needs and budget.

In addition, online business services typically charge lower fees than traditional payroll providers, making them an attractive option for small business owners.

Costs can range from $20 to $300 per employee per month, depending on the features included. With cheaper plans, businesses can use basic online payroll features, although other services may be available for an additional fee. Full-service payroll solutions will cost more.

Some systems include an additional fee for a Global Registered Employer package. Employer of record means that the online payroll provider is responsible for filing the necessary reports and documents for hiring workers in international jurisdictions.

This is essential for companies that need to manage payroll in multiple countries.

How Do You Use a Payroll Service?

How you use your service will depend on the size of your team and the features the online platform offers.

The initial setup is straightforward with most providers’ business, whether you have two or 200 employees. You must create an account with an online payroll provider and then upload your employee information, including payroll deductions such as federal income tax, Social Security tax, and Medicare tax.

Payroll services are designed to automate most of the payroll process. Depending on the system chosen, this includes calculating employee salaries, making direct deposits to employee bank accounts, and many other tasks.

The Difference Between a Payroll Software and a Payroll Service

At first glance, payroll software doesn’t look that different from the payroll services you’re used to. However, upon closer inspection, you’ll notice some significant differences that can make choosing the type of salary you want to invest in easier.

Here are some key areas where these two options differ.

- Safety

Perhaps the most important difference between payroll software and services is security. Services require you to send them all of your employee information in order to run payroll. This includes highly sensitive data such as employee identification numbers, bank information, and employee records.

Of course, this is all done over highly secure channels with the highest level of encryption. But the fact is, you’re still sending your susceptible data.

Payroll software business, on the other hand, allows you to handle all your payroll requirements without handing over any sensitive data to anyone. You store all your information on your servers; only your eyes can see these details. Therefore, it is a safer option, without a doubt.

- Convenience

Payroll services businesses have an advantage over payroll software in this regard. While it’s straightforward to get paid from primary online payroll services these days, handing over all the information for someone else to push those buttons is one step easier. Therefore, they are a better option if you are looking for phone-free payroll services.

- Price:

Of course, price is one of the most critical factors that many companies consider when comparing options. Payroll software, hands down, wins this battle.

This is because you cannot compare the pricing structure of software with the pricing structure of services. So, if money is essential, payroll software will win the war.

The Benefits of Using a Payroll Service

Payroll used to be the nightmare of any manager or employer. Once a month (or possibly more, depending on the company’s pay structure), they had to face the painful task of calculating, verifying, executing and organizing each employee’s salary.

This included vacation, sick leave, vacation days, and salaried, hourly, temporary, and contract workers. Everyone breathed a sigh of relief when payroll services and software came along.

The obvious benefit of using a payroll service is that it takes this time-consuming task off your shoulders and mind. Apart from this, there are other benefits that a smart business owner can gain from using a reliable service, such as:

- Eliminate human error

Companies lose thousands of dollars yearly because of a misplaced period or a forgotten zero. When people crunch numbers, mistakes can occur. When machines do the work, that margin of error is reduced to negligible numbers or eliminated.

- Tax compliance

Most good payroll service providers will also offer tax compliance and documentation as part of their packages. This includes calculation, filing, reporting and other necessary tax requirements. It also means you’ll be fully compliant as these services are updated to meet the ever-changing legal requirements for each state and business.

- Keep employees informed

Payroll services keep all important payroll data in a secure yet easily accessible location for all employees. So your employees can quickly print payslips, see their annual payments or add information as needed.

Other benefits include saving money through data reporting and business analysis, improved time efficiency and human resource management, such as onboarding new employees, calculating vacation days and managing benefits.

How to Choose the Right Payroll Service for You

While you can’t tell a company which software or service is best for them, there are key features to remember when comparing prices.

Before signing up for any service, such as full-service payroll software, make sure you check these necessary boxes:

- Complete Payroll Management—Nowadays, running payroll requires little more than pushing a button or two.

- Easy payment methods. Whether you prefer direct deposit, charge cards or business checks, make sure your payroll software has the options you want so you can pay your employees quickly and easily.

- Tax Filing – This is one of the most significant benefits of using payroll software today. Please ensure the payroll service providers you’re looking for are fully tax compliant, meaning they file all of your federal, state and local taxes, stay up-to-date on changes, and submit forms and files like W-2s and 1099s for everyone—his employees.

- Compensation Management. Taxes aren’t the only thing to manage. Make sure your online payroll services take care of workers’ compensation, bonuses, adjustments, and any other extras required by law.

- HR Benefits Management. What benefits are included in the HR features of your payroll service? Does it include human resources services? Will they take care of health care, like dental or vision care? Are there additional benefits, such as fitness and mental health packages? The more you can give to your employees, the happier and more productive they will be.

- Self-service of employees. This is not an essential feature, but it is functional. Employee self-service means your employees can submit information themselves. So you don’t have to waste valuable time entering all that data. It also means your employees can access their information to print their pay slips or check how many vacation days they have left without bothering you with searching for this simple data.

- Reporting – Reporting is an important feature that allows you to gain valuable insights into your organization’s internal operations. From tax and budget summaries to employee insights like employee productivity reviews, reporting is an essential form of business intelligence you won’t want to be without.

Why Payroll Services Are Crucial for Small Businesses

For small business owners, online services offer an efficient solution that saves time, money, and effort. Payroll tasks such as calculating and filing taxes on time can be time-consuming and require expert knowledge. Payroll services allow business owners to focus on their core areas.

Online platforms are much more reliable and accurate than manual calculations, making it easier for businesses to comply with state and federal laws related to payroll taxes.

Our Methodology: How We Rated Our Top Payroll Services

When writing our reviews, we examine each service provider in depth. Our team visits each provider’s website to learn what features the platform offers, what sets it apart from other payroll software, and how much it costs.

We use software demos when available to evaluate usability. When not, we watch product videos and talk to the vendors’ customer service teams to learn more about what each piece of software can do.

We also conducted an in-depth peer review to compare payroll software platforms. This included reviewing what features are available and at what cost for different providers and identifying the unique aspects of each platform.

Finally, our team thoroughly analyses customer reviews to assess how businesses of various sizes use each service. We also check peer reviews and communicate with each provider’s customer service team to ensure we’ve thoroughly covered every aspect of each software.

Other Payroll Services and Software We Reviewed

Can’t find what you’re looking for on this page? Here are some other services and software we’ve reviewed so you can find one perfect for your business needs.

- Dishonesty

- Salary insurance

- Roll by ADP

- Escort

- KPMG Spark:

- Patriot Software:

- Xero:

- It just works

The Bottom Line

Online payroll services are becoming increasingly popular among small businesses. They offer an efficient online management method, saving companies time and money.

The company you choose should provide all the required features and be affordable for your business, so it’s essential to research.