This is where a home warranty plan can come in handy. Protects your investment and reduces repair costs that can put you in debt. However, comparing home warranties can be confusing and time-consuming. Exclusions, coverage limitations, and service charges are just some of the key factors to investigate.

To make it easier for you and better understand what to look for, we evaluated the most popular companies in the industry and compiled a list of the best home warranty providers.

Our Top 10 Best Home Warranty Companies:

- Choice Home Guarantee :Best Overall Home Warranty Company

- Choose Home Warranty: Reasonably Priced Premiums and Rates

- American Home Shield: Best for Custom Plans

- Home Warranty of America: Best for Comprehensive Appliance Coverage

- America’s First Home Guarantee: Best for High Payments

- Home Maintenance Club: Best for Covering Pre-Existing Problems

- Liberty Home Guard: Homeowners Looking for Fast Claims Processing

- Elite Home Warranty : Adjustable Warranty Policy

- Mike Holmes Protection: Unlimited coverage for home systems and up to $6,000 coverage for appliances.

- 2-10 Home Buyer Guarantee : Best for Fast Service

Our Review Methodology: Evaluating the Best Home Warranty Companies

It is important that you get the best advice and information when comparing home warranty companies. That’s why, in addition to the main criteria in our list below, we also take into account public opinion of customers and draw on industry experience to offer only high-quality services. Our methodology is based on the following factors:

- Average annual premium

- Number of contractors

- Service call fee

- When can service requests be made?

- Coverage range

- Types of plans available (premier, gold, platinum, etc.)

Our Top 10 Best Home Warranty Companies – Quick Reviews:

Choice

Choice Home Warranty is an ideal affordable option for first-time homeowners. Choose between their customizable Basic Plan (12 items) and General Plan (16 items) for coverage of up to $3,000 per successful claim.

DebtHammer CEO Jake Hill notes that the Choice Home warranty is also “particularly helpful for older homeowners” because they are not “denied coverage based on the age of their home systems or appliances.”

Instead of changing service fees, they only charge $85 per claim. You also get your first month free if you’re a new customer.

Why we choose Choice Home Guarantee. Setting itself apart from other services, Choice Home Warranty responds quickly to inquiries and claims, provides reliable customer service, and has affordable annual premiums.

Our Experience: We were impressed with Choice Home Warranty’s quick response time when making claims online and over the phone. The support professionals we worked with were knowledgeable and quick to provide helpful information.

Read the Choice Home warranty review

PROS

- Low premiums

- First month free

- 24/7 phone and online home warranty solutions

CONS

- Coverage limits of $250 to $3,000 per item

- Not available in California

Select Home Warranty

Select Home Warranty provides competitively priced coverage for major appliances and systems. Their premiums start at just $36 per month, which is more affordable than other home warranty companies.

Jennifer Spinelli, real estate professional, investment advisor, and founder and CEO of Cash For Houses, calls Select Home Warranty “reliable and trustworthy.” She adds that she no longer has to worry about “expensive repairs or replacements due to accidents or breakdowns.”

There are three different plans available and all include free roof leak coverage. However, Select Home Warranty services are not available in Nevada, Washington, or Wisconsin.

Why we choose Select Home Guarantee. Their affordable premiums and minimal rates set them apart from their competitors. It is also convenient that they offer two months free with their annual plan.

Our experience. We were particularly impressed with Select Home Warranty’s friendly 24/7 phone support and free roof leak coverage.

Read the Select Home Warranty Review

PROS

- Affordable premiums and rates

- 24/7 phone support

- Free Roof Drain Coverage

CONS

- Lower coverage limits

- Not available in Nevada, Washington or Wisconsin

American Home Shield

American Home Shield, in business since 1971, is the largest and most respected company in the U.S. home warranty market with more than two million members.

Tommy Gallagher, former investment banker and founder of Top Mobile Banks, was “impressed with the range of contractors available and the quality of service provided”.

Choose from their three customizable plans: ShieldSilver, ShieldGold, and ShieldPlatinum. The ShieldSilver plan only covers 14 major systems, while the ShieldGold plan covers 23.

For additional benefits, ShieldPlatinum comes with full system and hardware coverage. This includes cost-saving extras like free HVAC tune-ups, unlimited air conditioning refrigerant, coverage against leaks and code violations, and higher payment limits for repairs and replacements.

Why do we choose American Home Shield? They operate in 47 states and Washington DC, and you can customize your plan. American Home Shield automatically covers duplicate items and older items with rust or corrosion.

Our experience. We found American Home Shield to be a great option for anyone looking for highly customized plans and access to a broad network of contractors. We could easily find a program that suited our needs.

Read the American Home Shield Review

PROS

- Highly customizable plans

- Includes undisclosed pre-existing conditions.

- Covers old things including rust and corrosion.

CONS

- There is no guarantee of repair time.

- Not available in Alaska, New York or Hawaii

Home Warranty of America

Home Warranty of America has comprehensive policies that cover most appliances and home systems. Offering up to $15,000 in annual coverage for repairs and replacements, they also have 24/7 phone or online support requests and a 30-day money-back guarantee.

They may be a little more expensive than some of the competition, but you get a lot for your money. All plans come with a per-service visit deductible.

Why we choose Home Warranty of America. Home Warranty of America provides nationwide service and is a good value when covering all appliances.

Our experience. We were impressed with the home warranty and efficient US customer service. It was easy to set up a plan and we appreciated their 30-day money back guarantee.

Read a review of Home Warranty of America

PROS

- Covers most appliances.

- High coverage limits

- 30 days money back guarantee

CONS

- 30 day waiting period

- 10% cancellation fee

The First American

The First American home warranty is the ideal choice for those looking for solid home protection for their systems and devices. The company has been in business since 1984 and claims to have saved homeowners more than $219 million in renovation costs.

Coverage comes in two basic plans and one premium plan. The best features of the First American Home warranty include that it protects items regardless of their age and replaces defective items with new equivalents if they cannot be repaired.

Why We Choose First American Home Warranty First American Home Warranty offers specialized programs for both real estate professionals and service providers. They also have a 24/7 complaints service, fully vetted merchants and a transparent application process.

Our experience. We liked First American Home Warranty’s response times, which were significantly faster than other companies.

Read the First American Home Warranty Review

PROS

- 24/7 claims support

- Fully verified merchants

- Low prices and service fees.

CONS

- It is difficult to understand the price breakdown without a personal quote.

- Your application is poorly rated.

Home Service Club

Home Service Club (HSC) offers two service plans: Standard and Comprehensive. The Standard plan includes 18 major devices and systems, while the Comprehensive plan includes 33. Additional extras such as pool and roof cover are available at an additional cost.

HSC’s unique plans include pest damage and utility line coverage, setting them apart from other home warranty services. You can also choose the amount of your service fee from three options ($65, $95, and $125), and all repairs come with a 90-day warranty.

However, HSC charges above-average service charges and surcharges. You must also live in a single-family residence, condominium, townhouse or multi-family property to qualify for the program.

Why we chose Home Service Club? HSC has a wide selection of optional extras including coverage for gas lines, grinder pumps, pipelines, swimming pools and spas. In addition, the company’s services are available throughout the country without exceptions.

Our experience. we appreciated that HSC provides pest damage coverage, which many competitors do not.

Read the Home Care Club review

PROS

- Provides coverage for pest damage

- Available nationwide

- 90-day warranty on all repairs

CONS

- High base premiums and service charges

- Do not list prices on the website

Liberty Home Guard

With high ratings and excellent reviews, Liberty Home Guard has a reputation for providing reliable service to customers.

They have three plans available (Systems Guard, Appliance Guard and Total Home Guard) with optional financial protection for roof leaks, freestanding freezers, generators, carpet cleaning and pressure washing. New policyholders also get free limited roof leak protection and two months of free coverage.

Liberty Home Guard’s exceptional claims process sets them apart from other home warranty providers. They have a 24/7 call center and guarantee to assign a contractor to a claim within 24 to 48 hours. They also have a network of over 10,000 qualified technicians in all 50 states.

Liberty Home Guard has launched a comprehensive mobile app that revolutionizes the way homeowners manage their escrow accounts, file claims and access real-time information. The app offers features like easy access to warranty details, efficient claims management, streamlined payment tracking, seamless communication with technicians, real-time notifications, and a wealth of home maintenance knowledge.

Why We Chose Liberty Home Guard: Liberty Home Guard’s rates start at just $1 per day and their technicians arrive within 24 to 48 hours of filing a claim.

Our Experience: We are pleased with Liberty Home Guard’s reliability, fast claims processing, and excellent customer service.

Read the Liberty Home Guard Review

PROS

- Excellent client service

- Currently offering two months free.

- Highly valued by customers.

CONS

- Not available in Wisconsin

- Less technicians compared to other companies

Elite Home Warranty

Elite Home Warranty offers highly customizable home warranty policies. You can choose from three warranty packages and dozens of optional add-ons, or create a completely custom policy that protects the devices and home systems you care about most. You can also adjust your coverage limits and copayments for service visits. Overall, Elite Home warranty policies are comprehensive and affordable.

Elite Home Warranty is one of the few home warranty providers that allows you to choose your own service technician. The company also has a nationwide network of contractors and can dispatch them within 24 to 48 hours of your claim. You can file a claim 24/7 online, by phone, or through the Elite Home Warranty mobile app.

Read the Elite Home Warranty Review

PROS

- Select custom coverage limits

- In-network service technicians or choose your own

- Submit claims 24/7 online, by phone or through the app

CONS

- Copays for service visits can be up to $130 each time.

- The service performance guarantee is only 30 days.

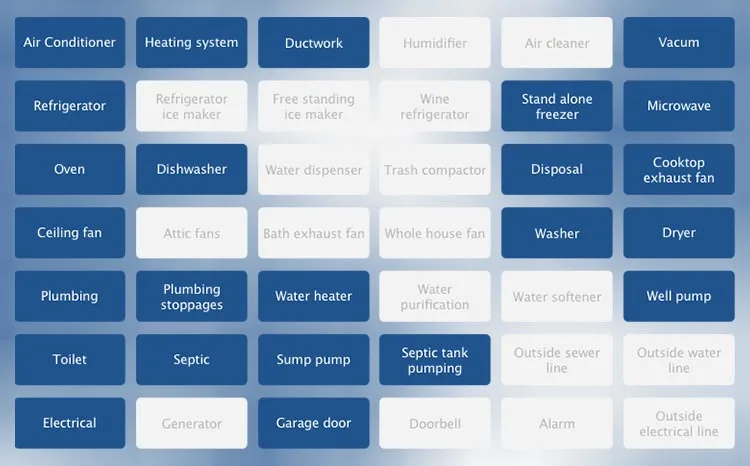

Mike Holmes Protection

Mike Holmes Protection offers adjustable home warranty policies that provide unlimited coverage for your home systems and up to $6,000 in coverage for your appliances. The company has a network of more than 11,500 contractors and responds to requests 24 hours a day, 7 days a week.

Why did we choose Mike Holmes Protection? Mike Holmes Protection is more expensive than the competition, but you’ll have peace of mind knowing that even the most expensive repairs will be fully covered. The company also has excellent reviews from owners for its quick response to complaints.

Our experience. I found the support team at Mike Holmes Defense to be very responsive and very helpful. I also love that you can get a free quote and sign up online in just a few minutes.

Read Mike Holmes’ defense review

PROS

- Unlimited coverage for home system repairs.

- Multiple plans with multiple add-ons

- Great reputation for quick repairs.

CONS

- Available only in 36 states

- Premium costs are higher than the industry average.

2-10 Home Buyers Guarantee

2-10 Home Buyers Guarantee has 40 years of experience in the home warranty industry. It offers 3 plan tiers: $19.99 per month, $51 per month, and $60 per month. Service fees are adjustable and range from $65 to $100 per visit, but the base fee is $85. 2-10 HBW offers a generous annual coverage limit of $25,000, so you’re protected in the event of multiple device or system failures.

To get started, simply visit the 2-10 HBW website or call customer service. You can purchase a warranty at any time, whether you’re buying, selling or currently living in your home. Support is available 24/7 and you can expect a service call within 24 to 48 hours of submitting your claim.

Benefits:

- Annual coverage limit up to $25,000

- Covers casual wear

- Service charge refund if item not covered

- Customers receive discounts on GE and Whirlpool appliances

Plans and Pricing:

The 2-10 Home Buyer’s Warranty offers three plans and optional additional coverage.

- Simply Kitchen – includes six kitchen appliances

- Complete house. covers 22 appliances and home systems, including all those covered by the Simply Kitchen plan

- Pinnacle Home. covers 32 appliances and home systems, including all those covered by the Complete Home plan

States Serviced:

The 2-10 home buyer warranty is available in 42 states, but not available in Alaska, Hawaii, Montana, New Hampshire, North Dakota, Oklahoma, South Dakota, and Wyoming.

Read 2-10 warranty reviews for home buyers

PROS

- Available in 48 contiguous states

- Buy a plan anytime

- $25,000 annual coverage limit

CONS

- Expensive annual premium

- High base maintenance fee

Comparing the Top Home Warranty Companies

Now that you have more information about the top 10 home warranty companies, it’s time to compare them. The home warranty chart below outlines each company’s features and services, including coverage details, average annual premiums and customer experience.

Consider coverage inclusions and limitations when reviewing the chart. Look closely at maintenance fees to make sure you’re not overpaying for actual repairs in an attempt to save on the annual premium. Finally, read customer reviews to learn how each company performs, as well as the quality and timeliness of their repairs. With this information, you will easily be able to decide which company offers the best plans at the most affordable prices.

What is a Home Warranty?

A home warranty is a contract that provides customers with coverage for the repair and replacement of major home systems and appliances due to normal wear and tear. Offers protection against unexpected breakdowns, including repair or replacement of covered items such as air conditioners, boilers, refrigerators, washing machines and plumbing systems.

How Do Home Warranties Work?

Home warranties help homeowners cover the cost of repairing or replacing appliances, systems, and other household items that break down over time. When you purchase a home warranty, it’s like having a security blanket for unexpected repairs. If something goes wrong with covered products, the appliance warranty company pays for repairs or replacements up to your plan limit.

If you have a problem with a covered product, you can call the warranty company and they will send a technician to fix it. The technician will use parts from an approved list to repair or replace the product to get it working again.

You usually have to pay a small service fee or deductible for each repair or replacement job. His plan will cover the rest of the bill up to the amount of his policy. That’s why many people consider home warranties a valuable investment. You don’t pay anything if something breaks.

Are Home Warranty Plans Worth It?

Home warranty programs are worth it for many homeowners. They protect you from unexpected repairs and high replacement bills, especially for large appliances like refrigerators or washing machines.

There are many reasons to get a home warranty plan, including the peace of mind of knowing that if something breaks in your home, you may not have to pay as much to fix it. Many companies also offer additional coverage options such as pools, spas, extras or systems, so you can customize your plan to your needs.

Determining the Need for a Home Warranty

A home warranty can be beneficial in many situations, whether you are moving into a new home or a home you have loved for decades. For those moving into a newly built home, the warranty covers defects and malfunctions in the home’s major systems and appliances. It can even reduce overall maintenance costs during the first year.

Getting coverage for an older home is also a good idea because it protects against costly repairs due to aging and wear and tear. While most plans do not cover problems in older homes, there are some home warranties that cover pre-existing conditions, allowing for repair services at a reduced or no cost.

How to Choose the Best Home Warranty Plan for Your Needs

When you’re ready to purchase a home warranty plan, follow these steps to ensure you choose the best company for your needs.

- Explore different plans and compare features. Read about the different home warranty contracts available to determine which one best suits your needs. Consider the coverage limits, service charges, and other benefits each plan offers.

- Ask important questions. Contact home warranty companies if you have any questions about your plans. Make sure you understand what is covered and if any limits or restrictions apply.

- Get home warranty quotes from multiple providers. When you’re ready to buy, compare prices and request quotes from several vendors. Be sure to read the fine print of the contract before making a decision.

- Verify credentials. Look for companies that are certified by organizations such as the National Home Services Contracting Association to ensure they are reputable and have the proper licenses and regulations.

- Study customer reviews. Read home warranty reviews from customers who have used the company in the past. Check how reliable, helpful and responsive their customer service is to know how to file a claim or repair later.

Coverage Details of Home Warranty Plans

Basic home warranty plans typically cover major appliances and offer coverage for:

- Refrigerators

- Dishwasher

- Washing machines

- Dryers

- Stoves and ovens

- Garbage collection

Additionally, most home warranties cover the following basic home systems:

- Electric system

- Ducts

- the water heater

- Air-conditioning

- Cooling and heating system.

- Ancient

- plumbing system

- garage door

For an additional cost, many home warranties offer additional coverage for the following items.

- Tanks septicos

- piscinas buried

- bombas de pozo

- bombas de sumidero

- Septic systems

- aspiradoras centrales

- Balnearios

- Water heaters

Cost Considerations for Home Warranty Plans

Home warranty plans typically cost between $300 and $600 per year, which breaks down to $25 to $50 per month. Some companies offer monthly payment options, but pay annually if possible, as many providers offer discounts for this.

Additionally, most home warranty companies charge or reduce a maintenance fee each time. This can cost between $60 and $150. There may also be charges for after-hours repairs, special types of services, and other items not included in your plan. Please read the terms and conditions of your plan to understand exactly the fees associated with it.

Advantages of Purchasing a Home Warranty

An additional layer of insurance for your home, home warranties can cover costly repairs or help finance the replacement of major appliances and other items in your home. With a home warranty program, you can avoid surprise expenses and enjoy peace of mind knowing that all warranty issues will be covered.

Benefits for Homeowners and Landlords with a Home Warranty Policy

Homeowners and landlords can benefit from home warranty policies because they cover the cost of repairing and replacing major appliances and systems that will eventually break down. This is particularly helpful for landlords who rely on rental income to pay bills and maintain maintenance costs. With a home warranty program, they don’t need to worry about additional repair costs.

Homeowners also benefit by knowing that if something goes wrong, they won’t have to scramble to raise money or find a contractor. Most companies offer custom coverage options, allowing homeowners to select the specific items they need protection for.

What Types of Home Warranty Plans Are Available?

Home warranty programs are a helpful way to protect yourself against costly repairs. There are several types of home warranties, so it is very important to understand the coverage of each plan. Below is a summary of the different types of plans and what they include:

- Device-only plans. Basic appliances such as stoves, garbage disposals, refrigerators and ovens.

- Systems-only plans. Home systems such as plumbing, electrical and air conditioning.

- Comprehensive plans. both large appliances and home systems.

- Additional coverage. items not included in your basic plan, such as pools, spas, second refrigerators, septic tanks, sump pumps, and well pumps.

No matter which home warranty plan you choose, always read the fine print and ask questions before you commit. This way you can be sure that your investment in your home will be properly protected.

What Is Not Covered Under Warranty?

While home warranty programs provide homeowners with valuable protection, they may not cover everything. You often need a higher-tier plan or special add-on to cover certain things. Below are some items and situations that are not typically covered by most warranties:

- Accidents due to inadequate maintenance. You will have to pay for any damage or malfunction caused by improper maintenance or lack of maintenance. For example, if you do not change the filters in your HVAC system regularly, the resulting problems will not be covered.

- Damage caused by self-repair. Repair or replacement costs will not be covered if you attempt to repair any item yourself, causing further damage. Therefore, if you think something is wrong, you should always call a professional.

- Pre-existing damage.

- Cosmetic problems. Cosmetic problems, such as scratched tiles or paint on a wall, are considered minor repairs and are not covered by standard warranties.

- Code Violations. Your home warranty policy will not cover damages related to code violations, such as if you build an addition to your home without proper permits.

Step-by-Step Guide to the Home Warranty Claims Process

Filing a claim with your home warranty company doesn’t have to be overwhelming or complicated. You can follow the process below to resolve your issues quickly.

Step 1: Contact Your Home Warranty Company

Contact your home warranty company online, by phone, or by email. Give them all the relevant details about your problem, such as when it occurred, what happened, and what could be causing it. You may also be asked for photographs or proof of purchase, depending on company policy.

Step 2: Submit an Online Claim Form (If Required)

Some companies offer an online claim form that you must complete before accepting your claim. It helps the company understand its problem more clearly and can ultimately simplify the process for both parties. When completing the form, please read each field carefully before submitting to ensure the information is complete and accurate.

Step 3: Await Confirmation of Your Claim

After submitting your claim, you will need to wait for confirmation that it has been accepted. Most companies aim to respond within 24 hours, but this can vary depending on the severity of the issue. Please follow up if there is no response within a day or two; sometimes emails get lost.

Step 4: Check If You Need to Pay Service Fees

You will probably have to pay a maintenance fee before repairs can begin. Your home warranty company should provide clear instructions on how and when to make this payment. Ask questions to avoid misunderstandings afterwards and, of course, before the technician arrives at your door.

Step 5: Arrange for Repair or Replacement of the Item

Once your claim is accepted, the repair or replacement will begin. Depending on where you live and the availability of parts and services in your area, this can take anywhere from a few days to a few weeks. Many companies have a group of contractors that they work with on site, but they are not always reliable or communicative. Be sure to ask for updates throughout the process.

Home Warranty vs. Homeowners’ Insurance: Understanding the Difference

Homeowners insurance covers repair costs related to fire, flood, lightning, wind, hail, theft, vandalism, and liability protection (if someone is injured on your property). Specially covered items can include roofs, furniture, clothing, appliances and more, as long as the damage is caused by a covered issue or natural event.

Home warranties typically cover repair or replacement of major appliances and systems, such as air conditioning, plumbing, and electrical wiring, due to normal wear and tear. For similar reasons, your home warranty may also cover large appliances like dishwashers, stoves, ovens, and refrigerators.

Both protect the value of your home, so it’s important to compare your home warranty and homeowners insurance when making your decision.

Additional Home Warranty Companies We Reviewed

More Home Warranty Companies We’ve Reviewed

In addition to the top home warranty companies mentioned above, the following are also worth considering:

- Sears Home Warranty – Best Repair Guarantee

- HSA Home Guarantee: Best Without Home Inspection

- Landmark Home Guarantee – Best Pest Control Coverage

- HomeServe USA – Best Value Packages

- Amazon Home Warranty: Best One-Month Free Service

Bottom Line – Protect Your Investment with a Home Warranty

Our picks for the top 10 home warranty companies are Choice Home Guarantee, Select Home Guarantee, American Home Shield, Home Guarantee of America, First American Home Guarantee, Home Service Club, ARW Home, Liberty Home Guard, First Premier and 2- 10. Guarantee for home buyers.

Home warranties can help homeowners and homeowners save money on maintaining appliances and home systems.

Some plans give you access to additional benefits like extended appliance protection, free HVAC maintenance, and a network of vetted and certified technicians you can trust. These benefits alone make home warranties a good investment for many homeowners.