This was the reality for Jessica, who was a victim of identity theft when her wallet (and her identity) was stolen from her at a San Francisco bar in 2018.

But identity theft extends beyond our physical possessions. our increasing reliance on digital transactions amplifies the threat in the online world. For example, the Federal Trade Commission (FTC) recorded nearly 700,000 reports of credit card fraud alone.

Fortunately, affordable identity theft protection services offer a convenient way to monitor online activity conducted in your name. Below, we present a selection of the 10 most trusted identity theft protection services to help you protect your finances and assets from imposters.

Our Top 10 Best ID Theft Protection Services & Companies in 2023:

- Aura: Best Overall Identity Theft Protection Company

- LifeLock: Best for Norton Antivirus Users

- Identity Guard: Best for full spectrum protection

- Zander Identity Theft. Best for People Looking to Recover Their Identity

- Norton. Best for anyone who has or wants Norton antivirus

- myFICO: the best for the protection of the whole family

- IdentityIQ: Best for Fraud Protection

- IDShield : Best for Identity Assistance and Restoration

- robodeidentidad.com: the best for those looking to protect their credit

- MyCleanID : Best for Identity Theft and PC Maintenance

The table below provides a quick comparison of the best identity theft protection services on the market today. You can compare the cost of each service, see user ratings and reviews, and check out the key features of each service to help you decide which one is right for your needs.

In-Depth Reviews of Our Top ID Theft Protection Picks

Aura

- 60-day money back guarantee

- A complete suite of ID theft, financial fraud, and device protection tools

- $9/month or $108/year

Aura provides robust protection against identity theft, including online account controls, financial transaction monitoring and a secure digital “vault” to store sensitive personal data.

The suite also has a password manager that makes it easy to create and store multiple strong passwords. What’s more, Aura’s VPN uses high-end encryption to protect your online activity, especially on public Wi-Fi networks. In addition, they offer AI-powered antivirus and safe browsing tools that serve as a digital fortress against unwanted websites and fraudulent websites.

Aura monitors all three credit bureaus, Experian, Equifax, and TransUnion, as the Consumer Financial Protection Bureau (CFPB) recommends identifying identity theft. The CFPB also advises to be alert for credit check requests from unknown companies and suspicious accounts that Aura can monitor for you.

Why did we choose Aura? In the event of a data breach, Aura intervenes immediately with security alerts, comprehensive fraud resolution services and up to $1 million in premium identity theft insurance per person. The platform’s sleek, user-friendly interface also features a “Protection Summary” that conveniently displays active identity theft measures on a central dashboard.

Our experience. we were impressed with Aura’s 24/7 customer service. We appreciated that the US-based anti-fraud team was always available to personally assist us with fraudulent incidents. Should a breach occur, the team will work directly with us to develop a recovery plan and resolve the issue.

Pros:

- A complete set of tools to protect your identity and finances

- 60-day money back guarantee for annual plan

- 24/7 US based customer service

Cons - Fixed plans, no mixing and matching

LifeLock

- 60-day money back guarantee

- Norton antivirus users

- $9.99 per month

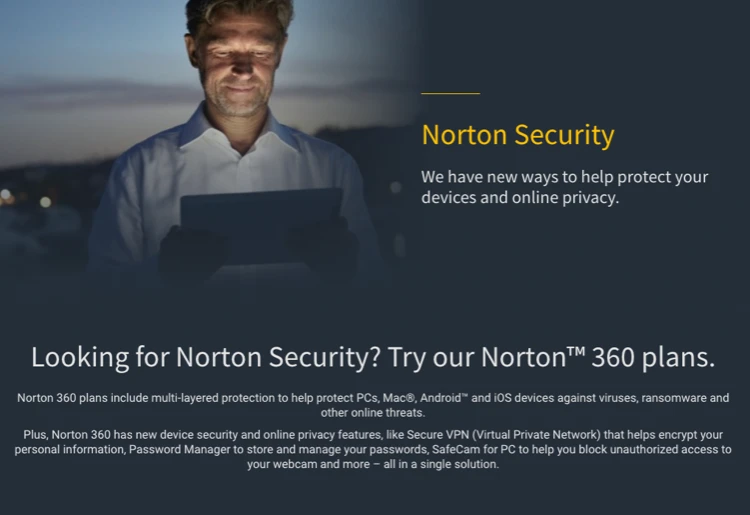

LifeLock, a heavyweight Norton antivirus product, has the technology, accessibility, and ease you’d expect from the industry-leading company. Most impressive are the plans themselves, which not only combine online security and identity theft protection, but also offer more flexibility than usual.

Lifelock plans include ID and Social Security number alerts and are offered in conjunction with Norton’s 360 suite. This means that the bundled plans give you VPN services plus robust identity theft features, such as stolen funds refunds ranging from $25,000 to $1 million, bank account and credit card activity alerts, and even credit card account alerts. 401(k) investment in the Ultimate Plus plan.

LifeLock also offers LifeLock Junior, an affordable add-on for children under 18 that includes:

Dark Web monitoring and searches on file sharing networks. All plans include 24/7 live member support and help from US-based identity restoration specialists.

- Refund of up to $1 million

- Antivirus and protection against cyber threats

- 60-day money back guarantee

Cons: - It’s only worth it if you want Norton 360

- Price can be confusing

Identity Guard

- Free trials. Forks

- Full spectrum protection

- $7.20/month or $79.99/year per month

Identity Guard has protected more than 45 million identities and resolved more than 140,000 cases to date. They partner with IBM Watson’s AI technology, using its advanced data analytics and predictive capabilities to enhance threat detection.

The service protects your online identity by monitoring the dark web (a notorious hub for cybercriminal activity) and alerting you if criminals are selling your personal information. Identity Guard also constantly monitors your personal and financial information, with their US-based support team always ready to resolve any issues that arise.

Why we chose Identity Guard? With 20 years of industry experience, Identity Guard stands out in providing effective identity theft protection and monitoring services powered by AI. These services immediately alert you to a wide range of potential threats. They also offer up to $1 million in insurance coverage per adult to cover legal fees and replace lost funds.

Our experience: we’ve found that even the most budget-friendly Identity Guard plan provides the highest level of protection against ID fraud. We were particularly impressed by the inclusion of dark web monitoring in this entry-level subscription package.

- Monitors credit score with all 3 credit bureaus

- Uses IBM’s Watson AI technology for optimal performance

- $2,000 emergency cash fund

Cons - No 24/7 customer service

- 3-Credit reports with Premier plans only

Zander Identity Theft

- No

- People seeking to recover their identity

- $6.75/month

Zander Insurance’s anti-identity theft service diligently scans the dark web to prevent criminals from selling personal information like your Social Security number and driver’s license number. The company offers plans for both individuals and families. It should be noted that their family plans cover two adults and up to 10 children at no additional cost.

Their top-tier package, Elite Cyber Bundle, includes online security features like VPN and antivirus protection. This service also protects against all forms of identity theft, including financial fraud, medical fraud, and child identity theft. Additionally, he is endorsed by radio host and financial guru Dave Ramsey.

The unique appeal of Zander Insurance is its focus on premium recovery service. They provide a dedicated US-based recovery team and up to $1 million per person in insurance coverage. However, to keep prices low, they do not offer credit monitoring or financial transactions, which they believe people can manage independently through banks and credit agencies.

Why we chose Zander Insurance? Their emphasis on top-notch identity recovery services, such as full-service recovery, makes them a great choice for those at high risk of identity theft. This includes previous victims of identity theft, people who frequently transact online, and people active on multiple social media accounts.

Our Experience: We were impressed with Zander Insurance’s commitment to personalized identity recovery and premium identity theft insurance, particularly given their long-standing reputation as trusted insurance providers. We also appreciate that Zander provides access to a trained team of specialists ready to address any identity breach promptly.

Pros:

- Unlimited family plan

- One of the most affordable options.

- Comprehensive recovery services, including lost wage coverage.

Cons: - No credit monitoring

- No free trial period

Norton

- 60-day money back guarantee

- Anyone who has or wants Norton Antivirus

- $9.99/month

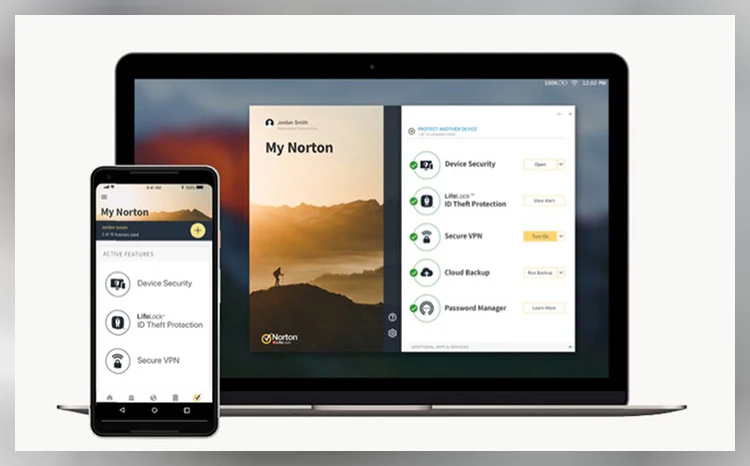

LifeLock operates under Norton, a well-recognized leader in online security. Although the use of other Norton products is not a prerequisite, their products are seamlessly integrated if they are used. This service quickly detects potential threats and alerts you via calls, text or email. Furthermore, it ensures that a dedicated ID recovery specialist is always available to help resolve the issue.

LifeLock offers three subscription plans with varying degrees of protection. The standard plan provides $1,050,000 in coverage, identity alerts, dark web monitoring, and single bureau credit monitoring. In contrast, premium plans offer up to $3 million in insurance, crime alerts in your name, and protection against phone bill capture.

While LifeLock only includes three-bureau credit monitoring in its highest-level annual package, daily updates are available for single-bureau monitoring. Furthermore, this product is an ideal add-on for existing Norton users, as some online security features, such as VPNs, are bundled with Norton’s antivirus products, not LifeLock.

Why did we choose LifeLock? At the core of Norton, LifeLock offers strong protection against identity theft. Its design is user-friendly and easily navigable. Notably, even the most basic membership level includes 24/7 live member support, ensuring consistent, reliable help when needed.

Our experience: we were impressed with LifeLock’s comprehensive insurance options, always available customer support, and cost-effective pricing structures. However, we found room for improvement. credit monitoring from the three bureaus should be standard across all their subscription plans for comprehensive credit monitoring.

Pros

- Includes Norton Antivirus

- Offers 3-bureau credit monitoring

- User friendly mobile application

- No family plan

- Expensive compared to other services

myFICO,

- No

- Protection for the whole family

- $19.95per month

myFICO, the consumer division of FICO, the company behind FICO credit scoring, offers a robust identity theft defense plan with comprehensive credit report monitoring, especially aimed at those looking to improve their credit.

The platform delivers significant value through extensive monitoring across three offices and 24/7 identity restoration services. It also includes $1 million in identity theft insurance. However, while the advanced tier offers quarterly updates, the main subscription provides monthly updates. Receive alerts about any inquiries made to your credit reports, which could indicate fraudulent use of your personal information. Unfortunately, myFICO does not offer a free trial or family plans. Although you can cancel at any time, they do not offer refunds.

Why we chose myFICO: myFICO sets itself apart from the competition by prioritizing comprehensive credit monitoring across all three bureaus, regardless of the subscription plan selected. Their credit inquiry alert system also serves as a unique potential fraud warning feature.

Our experience: We were impressed with myFICO’s dual focus on credit monitoring and identity theft protection, making it an invaluable resource for people looking to improve their credit scores while ensuring online security. . We especially liked the FICO score simulator, which allows users to visualize how different financial decisions could affect their credit score.

Pros

- Monthly and quarterly reports.

- Receive alerts by SMS, email or mobile app

- 24/7 customer support

Cons - The basic plan only includes coverage for 1 office

- Minor limitations on some credit report data

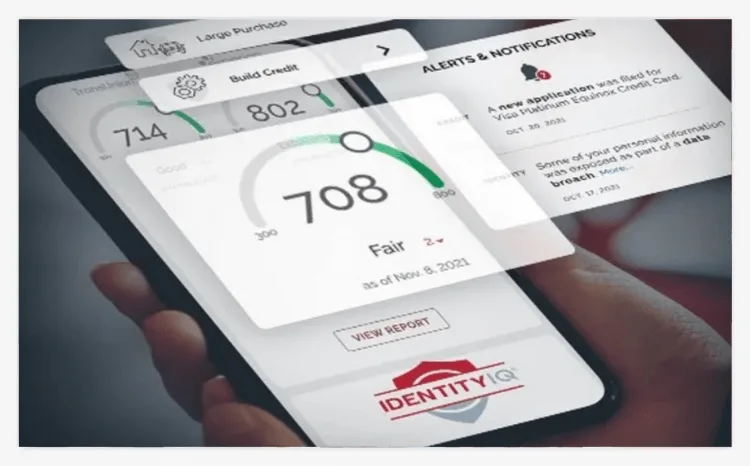

IdentityIQ

- None:

- Best for customizable identity theft protection

- From $6.99/month

IdentityIQ offers comprehensive protection against identity theft and fraud through its easy-to-use mobile and desktop applications. Provides peace of mind with various monitoring features, ensuring your personal information is safe from misuse. The service is available in four plans, to suit different needs and budgets, and even the basic level offers up to $1 million in identity theft and loss of income coverage. However, it lacks social media following and shares information with third parties for promotional purposes.

Key features include dark web monitoring and family coverage in higher-tier packages. IdentityIQ monitors credit reports from up to three bureaus, Internet and dark web activity, and address changes with credit reporting agencies. It also offers optional Bitdefender Premium VPN and Total Security antivirus for additional protection.

Prices vary across four tiers. Secure, Secure Plus, Secure Pro and Secure Max, and range from basic to advanced features. All plans offer substantial coverage, with the top tier providing additional benefits such as identity restoration with limited power of attorney and family coverage for members under 24 years of age. Monthly and annual billing options are available, offering up to 35% savings. However, there is no free trial option.

Why we chose IdentityIQ? Offering up to $1 million in identity theft insurance on all plans, including family coverage options in higher-tier packages, ensures extensive coverage and peace of mind for users.

Our Experience: We appreciate the comprehensive customer support that IdentityIQ offers. We understood that when problems arose, guidance through the steps of identity theft recovery, such as contacting the credit bureaus and handling fraudulent activity on your credit reports, was taken for granted. After the fact, the IdentityIQ team proactively follows up on cases to ensure the issue is resolved.

Pros:

- Refund of up to $1 million of stolen funds

- Comprehensive dark web monitoring

- Real-time credit monitoring and identification

Cons: - No refunds for partial months

- No free trial option offered

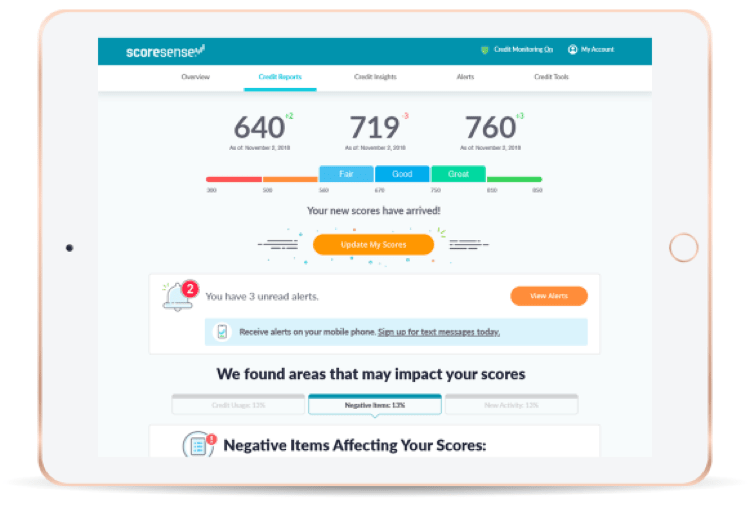

IdentityTheft.com

- forks

- Those who want to protect their credit

- N/A

IdentityTheft.com has partnered with ScoreSense to offer an effective identity theft solution. The platform runs daily scans to detect irregular credit report activity and other potential signs of identity theft, alerting you immediately of such occurrences. You also have the option to request full credit reports from all three bureaus to check for errors, unauthorized changes, or suspicious activity.

Furthermore, IdentityTheft.com extends its monitoring services to other personal accounts such as driver’s licenses or credit cards. It digs deep into the dark web to make sure your personal information isn’t being sold by cybercriminals. To enhance your protection, the service offers $1 million in insurance coverage to cover any financial loss due to identity theft.

However, if you want protection against a wide range of identity theft scams, you’ll need to manually set up additional account monitoring. This platform also does not provide a full-service identity solution in the event of a breach. Instead, they guide you through the necessary steps, from closing unauthorized accounts to filing police reports and FTC complaints.

Why we chose IdentityTheft.com. If you want to keep a close eye on your credit reports, IdentityTheft.com is a great choice. The service provides personalized advice with loan officers and a dedicated dispute center. Furthermore, it provides monthly updates from all three credit bureaus and proactively monitors daily for any unusual activity.

Our experience: we were positively impressed with IdentityTheft.com’s three bureau credit monitoring. If you’re willing to be proactive in protecting your online identity, this “one-size-fits-all” service should suffice.

- Ability to add multiple accounts to be monitored

- Continuous monitoring

- Instant alerts on suspicious activity

Cons - No pricing information

- No 24/7 customer support

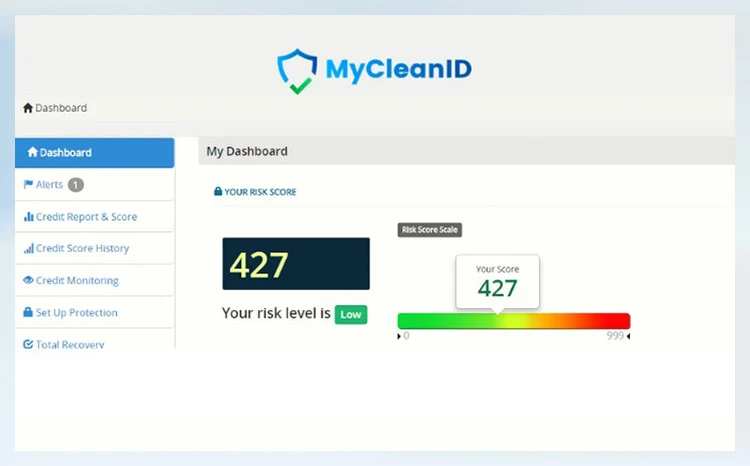

MyCleanID

- One-time free diagnosis

- Identity theft and PC maintenance

- $19.99 per month

MyCleanID combines identity theft monitoring with specialized diagnostic software to effectively protect against identity theft. This tool tracks your hard drive and hides the location of any data (sensitive information like phone numbers, email addresses, and credit card numbers) that could be exploited by identity thieves.

Additionally, MyCleanID constantly tracks changes to your credit reports, newly opened accounts, and suspicious activity linked to your Social Security number or physical address. The service even includes lost wallet protection, with up to $2,000 in emergency cash and a maximum of $1 million in identity theft insurance.

MyCleanID is unique in protecting both your local device and your cloud-based personal information. And all you need to do is download the diagnostic software to your computer. But while it will flag issues for free, fixing them will require a $19.99 annual subscription. Additionally, it lacks multiple subscription tiers with different levels of features.

Why we chose MyCleanID? MyCleanID employs diagnostic software that scans for security risks on your device, offering an additional layer of protection to your identity safeguards. The anti-identity theft product also provides consistent monitoring and alert systems. Ultimately, these could prove invaluable in keeping your information out of the hands of identity thieves.

Our experience: We did not see similar diagnostic software on any other competitor’s site. This tool really impressed us, as it gave us unique insight into how locally stored information could expose us to identity theft. However, at $19.99 per year on top of the monthly subscription fee, we’d prefer to see more customizable subscription tiers.

Pros

- Up to $2,000 of lost wallet protection

- Exclusive PC protection software encourages proactive online security

- 24/7 support in the US

Cons: - You need to pay a one-time activation fee

- Only 1 plan available

How We Reviewed the Best Identity Theft Protection Services – Our Methodology

With a wide variety of online identity theft services available, we’ve considered several factors to rank some of the best identity theft protection services.

We have reviewed the adaptability of their services, their cost, monitoring techniques, recovery process and customer service reliability. We also looked into providing additional online security tools, such as VPN access and antivirus protection, in addition to their basic identity security measures. Our evaluation criteria include:

- Monitoring methods including credit reporting and dark web monitoring

- Identity recovery methods: full-service or stand-alone?

- Cost effectiveness

- Availability of customer service

- Additional online security tools

- The degree of customization of the product

- User reviews

What’s Identity Theft Protection?

Identity theft protection services are designed to protect your personal information from fraudulent use, such as opening new credit card accounts or taking out loans in your name. Typically, most ID theft services feature identity and credit monitoring designed to detect suspicious activity in real time, such as unauthorized purchases.

Many also include insurance to reduce costs if a breach occurs and offer resources to help resolve theft issues and facilitate ID recovery.

How Does Identity Theft Happen?

Most identity theft occurs over the Internet when you don’t implement proper cybersecurity measures. Weak passwords can be easily guessed or cracked when using outdated antivirus software, leaving your data vulnerable to newer malware.

For example, one common trick is a phishing scam that lures you into submitting your information to fake websites. In these scams, you unknowingly hand over your passwords and personal information while the criminals remain unknown. An updated antivirus package, however, will be able to identify suspicious or dangerous websites.

Some hackers can also infiltrate your device directly using viruses or remote desktop software, while others infiltrate your accounts using malicious methods such as keylogging. In addition, criminals can steal your personal information through data breaches of companies or other organizations that have your data registered.

For example, an alleged hacker forum leak exposed the emails of more than 200 million Twitter users. dark web or other criminal forums.

If you suspect identity theft, act immediately. The potential damage extends far beyond data loss and can have serious consequences.

Why’s Identity Theft Protection Important to Have?

Identity theft protection is important because it quickly flags suspicious activity, allowing you to take preventative measures. Such mitigating actions may include disputing a fraudulent account or freezing your credit. Every second is important. The longer a criminal has access to your personal data, the more damage they can do.

Most identity protection services will do the heavy lifting, closing unauthorized accounts and contacting your bank and credit bureaus to report fraud. They also offer online security tools like VPNs and antivirus software to thwart hackers, preventing identity theft in the first place.

In addition, many of these services include insurance coverage in the event of a breach, giving you peace of mind that you will recover from any financial losses.

Do I Need an Identity Theft Protection Service?

Ultimately, the decision comes down to personal preference. Would you rather pay a small fee for coverage in case you are a victim of identity theft?

Reliable identity theft prevention services offer valuable protection against financial and identity-related harm caused by criminals and malicious actors.

High-risk individuals, especially, could significantly benefit from these advanced safeguards against identity theft. This includes previous victims, as their stolen information may be traded or sold between bad actors who could victimize them again, and those who frequently conduct confidential transactions online.

However, it is essential to understand that identity theft protection services do not completely prevent identity theft. With this in mind, it is becoming increasingly clear that you need to be smart and proactive when it comes to protecting your personal information.

How to Prevent Identity Theft

Signing up for an identity theft protection service does not prevent your personal information from being stolen. Instead, it allows you to take immediate action if fraud is detected. These services monitor various sources, including your credit files, social media accounts, and the dark web, to identify any signs of criminal activity.

Fortunately, there are some actions you can take to proactively prevent identity theft. These include the following:

- Regularly review your financial accounts. Frequently review your credit card and bank account statements to identify suspicious or unknown expenses.

- Use strong, unique passwords. By employing strong passwords (think: “SDjcks2347\]LKS”:>” vs. “Yourname2023”), you make it harder for criminals to guess or crack them and limit the potential damage if one of your passwords leaks or is stolen.

- Install updated antivirus software. Hackers often try to install malware on devices to gain unauthorized access or steal personal information. Using a reliable antivirus program can detect and block malicious software before it infiltrates your device, reducing the risk of this happening.

- Protect physical information. Make sure your mail is delivered to a secure location or locked mailbox. Also, shred all personal documents before throwing them away so they can’t be stolen from the trash.

Is an ID Theft Protection Tool Worth the Investment?

Yes, identity theft prevention tools are essential to ensure effective identity protection. As we become increasingly reliant on phones and computers, the threat of digital identity theft continues to rise. If you have been a victim of identity theft in the past, you are particularly vulnerable. And your risk increases every time you conduct confidential transactions online.

If you want to add an extra layer of security to your life and reduce the risk of identity theft, consider spending a few dollars a month on an identity theft protection service.

What Types of Identity Theft Protection Services Are Out There?

Identity theft protection services offer a variety of features and varying degrees of protection. Some, like credit report monitoring, provide basic protection but don’t guarantee full coverage. Others are more comprehensive but also often more expensive.

Here is an overview of these services with an idea of their special offers and benefits:

- Credit report monitoring. Credit report monitoring services basically monitor your credit report activity in real time. This feature will notify you of changes, including loan applications or new bank accounts opened in your name.

- Identity monitoring. More comprehensive identity monitoring is designed to scan for compromised or stolen personal data from a variety of sources that criminals can weaponize. These sources include the dark web, common websites, and a variety of other databases.

- Restoration of identity. Reliable identity recovery services (which are usually part of an ID theft protection package) can greatly simplify the process of repairing the damage caused by identity theft. Some companies even provide professional assistance, which allows you to relax while professionals solve the problem.

- Identity theft insurance. Another important consideration is the type and level of insurance coverage associated with your identity theft protection service. Some provide a high level of coverage, protecting you from financial loss following identity theft.

Other Types of Identity Theft Protection Services

Tax-Related ID Protection

People who illegally obtain personal information such as a Social Security number can file false tax returns with the IRS. However, to combat the growing tax-related identity theft, the IRS teamed up with tax firms, payroll processors and state tax administrators. Together, they run awareness campaigns to educate citizens about safe practices.

Americans should protect their tax records, keep their Social Security cards in safe places, and use reliable security software and strong passwords when submitting sensitive personal information online.

Medical ID Protection

Although less frequent, medical identity theft is an equally serious threat. It includes the misuse of your personal information to obtain medical services or medicines. The dark web can trade this information so that complete strangers can use it, and medical providers can even use it to submit inflated or falsified claims to insurance providers.

For this reason, online protection of your data may not be sufficient. Experts recommend checking health insurance records annually for potential discrepancies.

Common Types of Identity Theft Scams

Criminals use various scams with the sole purpose of stealing your identity or personal information. However, not all identity theft cases involve modern technology, as phone scams and theft of physical information are still common. In fact, Americans lost a staggering $39.5 billion in the last year to phone scams alone.

Here are some common identity theft scams to be aware of:

Phishing. Phishing scams involve criminals posing as legitimate companies or organizations. These scams usually arrive via email or text messages that appear to be from trusted organizations such as banks. They often call for immediate action, such as updating personal or payment information, but once entered, this information is quickly stolen.

Hacking and data breaches. Even with the most advanced cybersecurity measures, everyone is still vulnerable to identity theft. Hackers use various techniques to access devices or corporate databases, allowing them to steal large amounts of personal information.

Form hijacking: Criminals can target online retailers or other unsecured service providers by inserting malicious code designed to help them steal your payment information. This technique often involves manipulating a form so that when you complete it, the code sends a copy of your information to the attacker.

Physical Theft: Physical identity theft continues to pose a significant threat. Reportedly, more than 50% of identity theft incidents between 2006 and 2016 were traced back to non-digital vulnerabilities. This form of fraud can occur through various means, including obvious theft of a purse, wallet, or mail.

Other Kinds of Identity Theft

In addition to the standard types of identity theft mentioned above, you should be aware of some less common ones.

Tax-related identity theft. Criminals can leverage stolen information, such as Social Security numbers, to file fraudulent tax returns with the IRS. Although efforts are made to mitigate this risk, it is still important to protect your Social Security cards and tax records.

Medical identity theft. Although relatively uncommon, medical identity theft occurs when someone uses your personal information to obtain medical services or submit falsified insurance claims.

Child Identity Theft. Scammers may steal children’s identities to open unauthorized bank accounts, apply for loans, and engage in other fraudulent activities.

Synthetic Identity Theft. This form of identity theft involves combining authentic (often stolen) information with fabricated data to create a completely fictitious identity.

What Are Some Common Signs of Identity Theft?

Here are some common indicators of identity theft to watch for:

- Financial Discrepancies: One of the first warning signs of identity theft is unusual or unauthorized transactions on your credit card or bank records.

- Your Mail Gets Lost. A common tactic criminals use is to redirect your mail to an address of their choosing. This allows them to receive your mail, giving them access to your sensitive information, such as bank statements, credit card details or other personal information.

- Debt Collectors Contact You: If someone has been using your identity to get loans and credit cards but hasn’t kept up with their payments, debt collectors may come after you for debts you didn’t know you owed.

- Your medical records show discrepancies. Some criminals may use your personal information to access medical treatment. If your benefits do not add up or you receive an unexpected medical bill, it could indicate that someone is using your information to receive “free” medical care.

- Your information is exposed in a data breach. Data breaches are surprisingly common. In fact, these breaches exposed more than six million data records worldwide in the first quarter of 2023. These data breaches often result in personal information being sold on the dark web, which could put you at risk of Identity Theft.

How Can I Find Out If Someone Is Using My Identity?

One of the most effective ways to detect online identity theft is to regularly monitor your bank and credit card statements. Financial institutions typically offer access to account statements through online platforms or mobile apps, so you can easily review your recent deposits, withdrawals, charges, and payments.

If you notice something you didn’t authorize, consider it a clear warning sign of possible identity theft. Additionally, it is essential to regularly check your credit report from the three major credit bureaus. Experian, Equifax, and TransUnion. You can access your credit reports for free by visiting www.annualcreditreport.com.

How to Report Identity Theft

If you are a victim of identity theft, it is essential that you report the incident to the FTC. You can easily do this over the phone or through their online platform; just be sure to provide as much information as possible.

Additionally, please contact your bank, credit card provider and any relevant organizations affected by fraudulent activity carried out in your name. It is also recommended to notify one or more of:

How to Choose the Right Identity Theft Protection Service

While all of the identity theft protection services listed here are great choices, it’s important to find one that fits your needs. Start by considering your budget to eliminate expensive options right away.

Next, assess your requirements. Do you prefer credit monitoring or comprehensive identity monitoring? What level of insurance cover do you need? Is professional help available if you are experiencing identity theft?

After considering these questions, you will be better equipped to make an informed decision. Remember that many providers offer free trials that allow you to test their services without any financial commitment.

Identity Theft Is on the Rise

Recent reports indicate a growing concern about identity theft. Credit card fraud, loan fraud and benefits fraud are alarmingly common. In fact, according to the FTC, incidents of identity theft in the U.S. will increase from more than 650,000 to 1.1 million between 2019 and 2022.

This trend can largely be attributed to the increasing digitization of our lives, which has led to numerous data breaches. These breaches have exposed the personal information of countless individuals, allowing criminals and ID thieves to take advantage of it.

Other Identity Theft Protection Services We Reviewed

In addition to the identity theft protection services discussed above, we have also researched and compiled a list of other brands that may be of interest to you. Check out this list of identity theft services to get an idea of the different pricing options, types of reports, and features offered across the board.

Experian – Best for dark web surveillance

Identity Protection – Best for affordable basic theft protection

ReliaShield – Best for family plans and free coverage for children

GOFreeCredit – The best of three bureau credit monitoring and credit signals

Avira – Best online security tools for Mac users

Credit Karma – Best for free credit report monitoring

Self Financing – Best for building credit

Stop Identity Thieves in Their Tracks

Investing in an online identity protection service is an extremely effective way to prevent online identity theft. However, it is important to recognize that no identity is completely secure in the digital age. That’s why features like identity resolution services and ID theft insurance provide added peace of mind to those looking for extra protection.

Choose the strongest anti-identity theft tool within your budget to keep you safe online. Even a basic or free credit monitoring service can go a long way in deterring identity thieves.