Bill.com is a solution to automate your accounts payable and receivables that integrates with cloud based accounting software like QuickBooks. While Bill.com has a few notable features, its competitors in the space, such as Sourcery, may offer a more dynamic solution that is customizable according to your specific needs.

Hereās what you need to know about these innovations for your back office tools ā including which one might be right for you.

Bill.com Features

Bill.com offers a wide range of features that help businesses manage their A/P and A/R workflows efficiently. Here are some of the key features of Bill.com:

Accounts Payable Automation

Bill.com automates the accounts payable process by capturing bills, digitizing them, and routing them for approval. The A/P automation process starts with capturing invoices through scanning or forwarding electronic invoices to a dedicated email address and then digitizing them to extract relevant information.

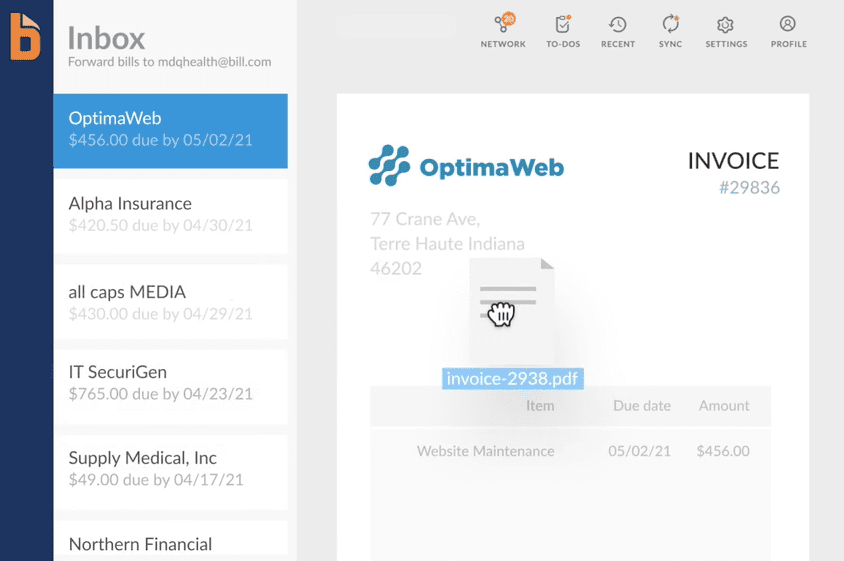

Bill.com has a feature called Inbox and it allows vendors to send their bills electronically to a unique email address created by Bill.com.

Inbox in Bill.com (Source: Bill.com)

After a vendor sends bills to your inbox in Bill.com, the software will automatically extract the relevant data from the bill, including the invoice number, date, amount due, and due date. This information will be used to create a digital record of the bill, which can be easily accessed and managed within the Bill.com platform.

Once the bill is in the system, you can review and approve it for payment, set up payment schedules, and even send payment directly through the Bill.com platform. By automating this process, you can save time, reduce errors, and improve efficiency in your accounts payable workflows.

Accounts Receivable Automation

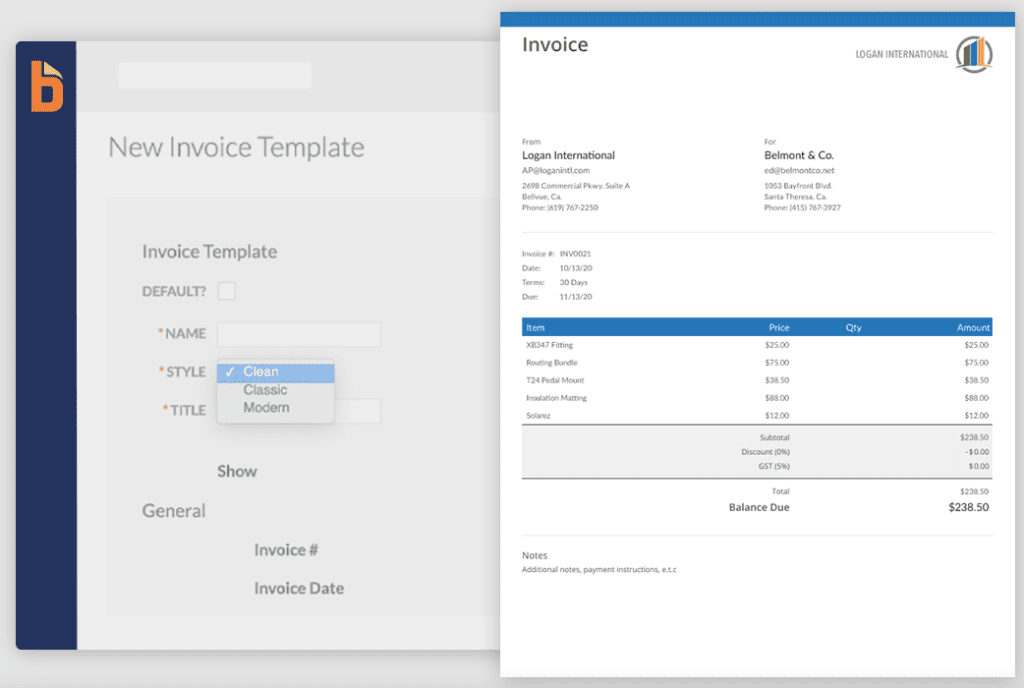

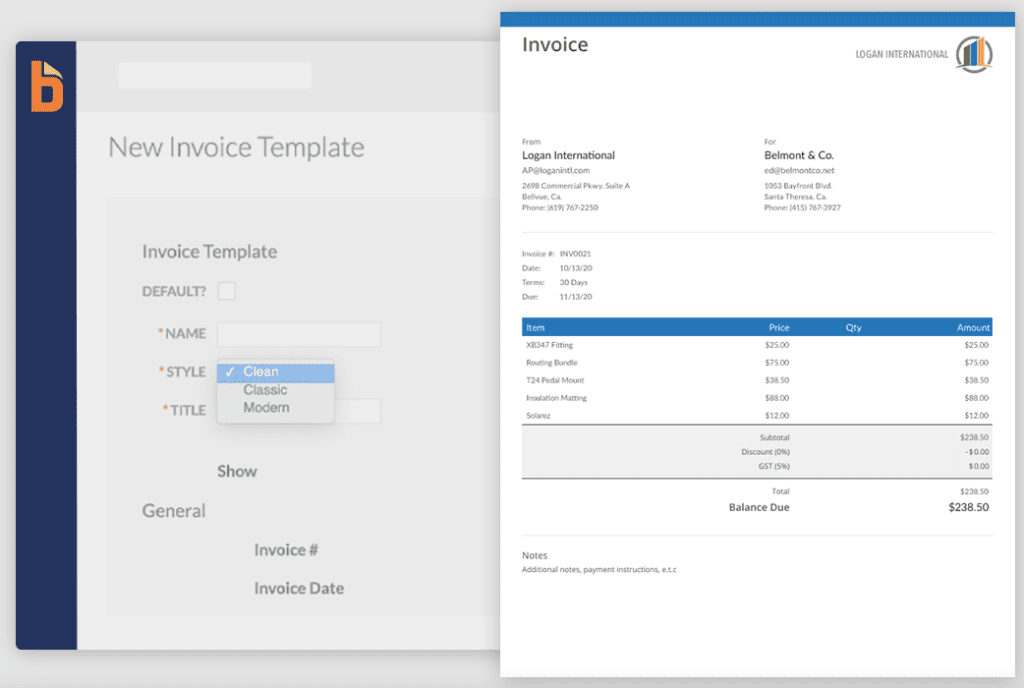

Bill.com makes it easy to create invoices, with customizable invoice templates available or the ability to upload your own templates.

Sample invoice template in Bill.com (Source: Bill.com)

Once created, invoices can be sent electronically via email, and businesses can track their status in real time through Bill.com. Once an invoice is sent, Bill.com automates the payment processing process, enabling customers to pay electronically through ACH or credit card, and providing businesses with real-time tracking of payments.

Bill.com also enables businesses to schedule recurring invoices, which can be automatically sent to customers at regular intervals. Also, you can send automatic reminders to customers with outstanding invoices, reducing the need for manual follow-up.

Document Management

With Bill.com, you can store and manage invoices, receipts, bills, and other financial documents in one centralized location, making it easy to find and retrieve documents when needed. The document management feature in Bill.com supports electronic document storage and eliminates the need for paper documents, reducing manual effort and improving efficiency.

Businesses can upload documents directly to Bill.com or capture them by scanning and forwarding electronic invoices to a dedicated email address. Once uploaded or captured, the documents are digitized, making it easy to search and retrieve documents through Bill.comās advanced search capabilities.

Customizable Approval Workflows

Approval workflows in Bill.com can be configured to match a businessās specific approval process and can include multiple levels of approval and custom rules for different types of documents. Certain users are assigned to approve invoices or bills based on their role within the organization. For example, an invoice may be automatically routed to a manager for approval before being sent to a finance department for final approval. This enables businesses to maintain strict control over their approval process, ensuring that invoices and bills are only paid once they have been approved by the appropriate parties.

Custom rules can also be set up within approval workflows in Bill.com. These rules can be based on criteria such as invoice amount, vendor, or department and can determine which users are responsible for approving specific invoices or bills. For example, a bill above a certain dollar amount may be automatically routed to a senior manager for approval.

Creating a bill approval workflow in Bill.com (Source: Bill.com)

Approval workflows in Bill.com enable businesses to track the approval process in real time and receive notifications when invoices or bills are approved. This provides businesses with real-time visibility into their financial operations and helps to ensure that invoices and bills are paid on time.

Automatic Bill Codification

One of the best features of Bill.com is that it learns from past transactions, enabling the system to automatically assign the correct general ledger (GL) codes based on the businessās historical data. As bills are captured in Bill.com, the system analyzes past transactions to identify patterns and establish rules for automatic bill codification. For example, if a business consistently assigns a certain GL code to bills from a particular vendor, the system will learn this pattern and automatically apply the same code to future bills from that vendor.

The system also takes into account any changes made to GL codes by the user during the approval process. If a user changes the GL code assigned by the system, the system learns from this change and applies it to future bills with similar criteria.

Automatic bill codification saves time by eliminating the need for manual bill categorization. Also, it reduces the risk of errors by ensuring that bills are consistently categorized and assigned the correct GL codes. Finally, it provides businesses with real-time visibility into their financial operations, making it easy to track expenses and analyze spending patterns.

Reporting & Analytics

With Bill.com, you can create customized reports based on specific criteria such as vendor, expense category, or project. Reports can be generated in various formats, including PDF, CSV, and Excel, and can be easily exported to accounting software or shared with stakeholders.

In addition to generating custom reports, Bill.com provides businesses with a dashboard that displays key financial metrics such as cash flow, outstanding invoices, and bills to pay. The dashboard also provides visual representations of data, such as charts and graphs, making it easy for businesses to identify trends and patterns in their financial data.

What to Look for In AP/AR Solutions

An automated accounting solution can help you streamline your back office. It is one way to get paid more quickly and to efficiently settle accounts. But there is a wide range of solutions to choose from. Some, like Bill.com, focus almost exclusively on digital invoicing, automatic payment, and account reconciliation.

Others, like Sourcery, are end-to-end solutions that include vendor management as well as streamlined invoicing and auto-reconciliation. Catered specifically to those in the restaurant industry as well as to emerging small businesses, Sourcery has the specialized ordering and inventory receipt capabilities that Bill.com lacks.

When you are shopping around for the right platform, you may need to decide whether you need only a billing tool or a comprehensive account management solution.

Bill.com Overview and Features

True to its name, Bill.comās primary function is to facilitate domestic and international payments. It includes all aspects of accounts payable, including electronic invoicing and a range of fund transfer capabilities.

With Bill.com you can receive digital invoices from vendors and ensure rapid approval. Similarly, you can create and issue invoices to your customers and receive settlement through ACH, ePayment, Paypal or credit card. The platform syncs easily with major accounting software like Oracle, Xero, QuickBooks and Sage.

Bill.com Reviews and Pricing

Bill.com has generally positive reviews. Users enjoy the automated features and ease of payment approval. Some users posting on Capterra noted the preview window could use improvement. Others mentioned syncing issues and limited rule capabilities. PC Mag noted it does not function like a double-entry system, and may therefore appear to be lacking in features. But, the magazine stressed, Bill.com is not trying to do everything that other solutions do.

On G2crowd, some users noticed frequent bugs when syncing with accounting software. A recent review complained of poor customer service, as they had an unresolved account issue and received no response from Bill.com's chat function and there was no option to call the company. Overall, Bill.com is well-regarded but some reviewers disliked having to pay more for extra features like invoice auto entry.

Pricing plans range from $29 to $59 per month per user, with the latter their most popular plan. In addition, the platform charges $19 per āapproverā user. There are additional transaction fees, including $0.49 per ePayment, $0.49 per bill for auto entry, $0.99 for a Paypal payment and $9.99 to $19.99 for fast pay fees.

Sourcery Overview and Features

While Bill.com focuses on payments, Sourcery offers a range of benefits to restaurant and small business clients. These include automated invoicing, online bill pay, domestic ACH and domestic and international check processing. It integrates with Xero, QuickBooks, Sage and a number of other major programs.

Sourcery has an extensive vendor management capability that allows for online ordering. The software is designed for food companies, who often have to modify invoices or issue credit notices because of spoiled food upon delivery. With Sourcery, these changes are seamless and easy. The platform enables rapid communication with vendors so time is not wasted with outdated, manual ordering processes.

In addition, the automated invoice digitization converts to usable data. Restaurants gain essential analytics about their restaurant costs. The platform has a price alert capability to let owners better track their spend on perishable ingredients. Because of this functionality, Sourcery can help clients make essential business decisions as well as balance their books.

Sourcery has a robust customer service team. Each Sourcery client has a dedicated account manager to help with any issues. The support staff are hands-on with every user, so clients can make the most of the productās full functionality.

How to Assess Which One is Best

In order to choose the best solution for your needs, it may be helpful to review some key pros and cons of each platform.

Bill.com

- Pros: Bill.com does an excellent job of automating invoices and streamlining payments. Approval processes are easy. The platform has extensive international payment capability.

- Cons: The subscription is by user and there are additional transaction fees for activity. Some users have complained that the integration of Bill.com with their accounting software is not as seamless as they would like. Others have complained about the lack of customer service.

Sourcery

- Pros: Sourcery is tailor-made for restaurant owners. It offers powerful analytics on inventory and price changes so owners can keep a handle on costs. It offers a similar invoice digitization as Bill.com and also has payment capabilities. Its direct ordering function streamlines vendor relationships. Customer service and predictable pricing round out the benefits of this platform.

- Cons: Since it is not specifically focused on accounts payable functionality, it may take more time to learn all of its features.

Perhaps the best way to decide which platform works best for your business is to try them out and see. Contact Sourcery today and request a free demo to see if the product helps you improve your business efficiency and success.

Leave a Reply